Story Highlight

– Home ownership for 25-34 age group has declined significantly.

– Welsh Conservatives propose scrapping land transaction tax (LTT).

– UK Conservatives announced similar policy for England, Northern Ireland.

– Eluned Morgan criticizes Tories for focusing on housing issues.

– Current LTT rates have not changed since 2022.

Full Story

In a pointed critique of the current housing landscape in Wales, Darren Millar, the leader of the Welsh Conservatives in the Senedd, has highlighted a significant decline in home ownership among younger adults. According to Millar, the rate of home ownership among those aged 25 to 34 years has experienced a staggering decrease of one-third since the turn of the century, when six out of ten individuals in this age demographic owned their homes. Millar attributes this downturn to the policies of the Welsh Labour government, which he claims, with the backing of their coalition partners Plaid Cymru and the Liberal Democrats, has failed to address the housing crisis in Wales.

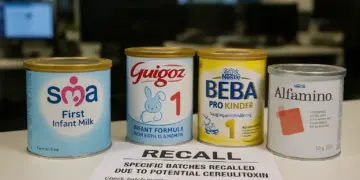

Millar has called for the abolition of the Land Transaction Tax (LTT), a Welsh variant of stamp duty, as part of his party’s strategy to revitalize the housing market and stimulate the economy. He expressed the belief that removing the LTT would facilitate home ownership for many and allow individuals to realize their aspirations of owning property. This proposal echoes a recent announcement made by UK Conservative leader Kemi Badenoch during the party’s conference in October, where she indicated plans to eradicate stamp duty in England and Northern Ireland, aimed at enhancing accessibility in the housing market.

In response to Millar’s criticisms, Eluned Morgan, a Labour minister, expressed disbelief at the Conservative party’s position on housing matters. She contends that the Tories’ focus on stamp duty is misplaced, arguing that the tax predominantly affects wealthier individuals. Morgan stated, “most people don’t pay stamp duty, so you’re obviously focusing on the richest parts of our community.” She further rebuffed Millar’s claims by highlighting the broader economic context, asserting that the main barrier to home ownership is elevated interest rates, which surged notably during the leadership of Liz Truss and previous Conservative administrations over the past 14 years.

Morgan pointed out that current trends are indicating a decrease in interest rates, alongside a decline in inflation and a rise in wages that outpace the cost of living. She suggested that these improvements signal a more favorable environment for potential homebuyers.

The Welsh government has exercised control over the stamping tax structure since 2018, when the power was transitioned from the Conservative government. Despite discussions surrounding the potential for reform in property taxation, the main residential tax rates in Wales have remained unchanged since 2022. Under the existing framework, homes valued up to £225,000 are exempt from the LTT. Properties bought for prices ranging from £225,000 to £400,000 are taxed at a rate of 6%, while homes valued between £400,000 and £750,000 incur a tax rate of 7.5%. Properties exceeding £750,000 face even steeper charges.

The debate over home ownership and fiscal policies underscores a critical issue confronting many young people in Wales today, as they grapple with changing economic conditions and navigate the complexities of the housing market. The arguments put forward by Millar and Morgan reflect wider concerns regarding accessibility to home ownership and highlight the ongoing political tug-of-war over economic stewardship and strategy in Wales.

Experts argue that the decline in home ownership among younger demographics can be attributed to various factors, including economic instability, rising property prices, and shifting socio-economic conditions. They stress that addressing these challenges requires a multifaceted approach, incorporating not just tax reform but also broader strategies aimed at increasing the supply of affordable housing.

As the Welsh Conservative party gears up for the upcoming Senedd elections, their focus on housing and economic policies is likely to resonate with constituents who are increasingly concerned about their ability to own homes. Millar’s call to eliminate the LTT is positioned not only as a financial remedy but as a means to reignite hope and ambition among young adults striving for independence in the housing market.

Conversely, Labour’s response highlights the complexities of economic policy in ensuring equitable access to housing. Strategies that seek to modify tax frameworks need to consider their broader impacts on various socio-economic groups, particularly those on lower incomes who may be less affected by stamp duty changes.

As discussions continue to unfold, the effectiveness of proposed policies and their potential implications for Wales’ economic landscape will come under scrutiny. It remains to be seen whether either party can present a comprehensive solution that tackles the underlying issues of housing affordability and accessibility.

In the broader context of the UK, the housing crisis has emerged as a key issue for many political parties, each vying to present their vision for addressing what has become a complex and multifaceted challenge. The differing approaches to taxation and home ownership reflect deeper divisions in philosophy and priorities, with significant implications for governance and policy development in the coming years.

Ultimately, the ongoing debate around home ownership and taxation underscores a vital public interest issue, shaping the future landscape of housing and economic opportunity for generations to come. Stakeholders are urged to engage in informed discussions to develop sustainable solutions that cater to the diverse needs of the Welsh population.

Our Thoughts

The article primarily discusses political opinions on housing market issues in Wales and does not present any incidents or safety concerns that fall under UK health and safety legislation. Therefore, there are no relevant safety lessons, regulations breached, or preventative measures that can be drawn from this content.